Business overview

Finance Manager is responsible for maintenance of records and relies on being given such information by you and your colleagues. It has the job of reporting on high-level financial issues, calculating financial issues and making fiscal payments. It reports on expenditures (Business Administrator uses the term Cost Codes) and expense usage.

Finance Manager manages VAT and offers the methods to pay that, and other taxes. Payment of such taxes are recorded, and entered into the Cash Book and other systems, as are any other transactions. It prepares the system for VAT reporting by offering the facilities such as Cash Book reconciliation and the facility to print mock reports.

Finance Manager also reports financial statistics from a number of perspectives and in a number of formats. It is within Finance Manager that you also set financial policies and values such as currency and tax rates. It can produce charts, including comparatives, on business performance from a number of views.

Important note: Take note of the warnings on the screens, though, as they appear. Laws and accounting procedures often change without people knowing, and Business Administrator could only know if it were told, and it is reliable to that degree. On major changes, Business Administrator may need to be upgraded. Variables (such as VAT rates) are changeable on the system, but processes are not, and you must keep the system up to date: one reason why you ought to keep in touch with the BAWorld website.

Note: Business Administrator currently only monitors the main current bank account for the business and takes no account of cash, investments or assets elsewhere.

Business Administrator possesses a number of tools that help to manage finance and, most importantly, position it for accurate reporting. Reporting systems exist to report the financial state of the business and to report on tax matters: its reports can be taken to accountants so that they can report on tax.

These reporting systems position it to make payments on tax, as well as a host of derived facilities.

Modes

Financial Reporting: These are general financial tools mostly to help with reporting, but also includes facilities for stating currency rates and tax rates.

Banking and Debt: This mode provides commands to manage issues regarding both banking and debt. For banking, Business Administrator lists the bank accounts that are registered on the system, and, debt, it lists the debts for which regular automatic payments are being made from the primary account, along with their state.

Taxation: This mode focuses entirely on tax issues, including reporting and paying them. Specialist ones include facilities for VAT, for companies that use it.

Asset Review: Every company has assets of one type or another. Here, we’re interested in tangible assets and ensuring the net worth is accurate, and that methods for accounting for it are available. Movements in the asset book are registered in VAT Returns and other reports.

Commands Overview

General Statistics: This command allows you to review sales and other statistics over certain periods. Generally you are offered an estimate for the current month (which may be erratic), the three previous months, the current month last year and the previous month last year. Zero values are displayed as blanks.

Financial Performance: This provides you with charting facilities through financial issues, with the facility of comparing one issue against another, across varying ranges of time. Look for trends here to help evaluate where your business is going.

It allows you to view graphs of the business performance. On opening, you get a view of the cash flow status for the last 12 months. You can change the range of the chart (the x axis) by adjusting the drop down boxes at the bottom of the dialogue. By selecting from the function list you can choose other data to be displayed. By choosing Use Comparisons, you can compare the current data with data of a different type, from the drop-down box above the chart. By working through these items you should be able to assess the strengths and weaknesses of the business on a cyclical basis.

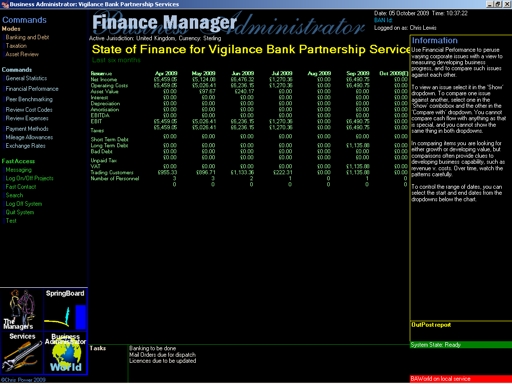

State of Finance: This provides a financial analysis of the legal entity over the previous five months, with estimates predicted for the current month. Watching the pattern of numbers here also helps evaluate where the business is going.

Review Cost Codes: Managing business costs is critical to controlling operating costs. This command allows you to view the costs, by what is often known as cost code (although Business Administrator doesn’t actually use codes – it uses names to prevent errors). You can view them over any given period and it will show only the cost codes that have been used in that period. If you isolate the month (by making both drop-down boxes below the chart identical), Business Administrator will display the actual items, so that you can home in on any particular issues.

Manage Cost Codes: Cost Code management is a technique for stating how your expenditure was used. In some cases it is important for tax reasons. But you generally use it for classifying, reporting on and controlling expenditure. You can add, edit or merge Cost Codes, but cannot delete them. In the case of adding one, enter the details as required, and add it. In the case of editing, select the one you'd like to edit, and edit it. In the case of merging, Business Administrator will transfer all items of the second Cost Code to the first one.

View Expenses by Month offers you a list of the expenses by varying issues and who is responsible for them, thus offer ways to keep expenses under control.

Payment Methods: Money flows in an out of a business in a variety of formats, for example, cheques, cash, etc. This system allows you to define and manage the full range of those formats.

Mileage Allowances: If you use business travel, particularly cars or vans, you will want to reclaim the mileage. This system allows you to define the types of mileage (as issued by a tax office), so that they can easily be reclaimed through the expenses system.

Exchange Rates: If, for any reason, you are involved in foreign currency then you can tell Business Administrator about the changing exchange rates here. You may run multi-currency invoicing. If you do use the exchange rate system, then it is critical to keep it up to date – perform it daily, even twice daily if necessary. Business Administrator does not keep a track of the history of currency rate exchange.

It is important to tell Business Administrator immediately of any changes in the rates.

For example, European companies often express the totals of invoices in both their home currency (e.g., Sterling for the UK) and Euros. Although exchange rates should be kept up to date, it is obviously critical that they are so before an invoice run if you express totals in non-native currencies. Exchange rates are available from varying Internet sites, but you need to choose one that is reliable, accurate and consistent.

Key Exchange Rate in the Exchange Rate dialogue allows you to group the Exchange Rates you frequently work with. You are unlikely to enter information for a Jurisdiction that you don't use. Thus Key Exchange Rates is a method of displaying only the ones you do use. If you want to use other currencies, you should define them on invoices when you set up customer parameters in Trade Manager. Thus, in an invoice run, some invoices would have a variety of currency and others would not.

Tax Rates: Likewise, tax rates are constantly changing. This system allows you define taxes types and costs, as issued by your local tax office.

Tax payments: From time to time you will need to pay taxes. This facility allows you to enter details of the payment. Business Administrator will keep a record of the payment, and will also display estimates on what the amount should be. These estimates are only estimates and should be validated by an authorised accountant.

NOTE: Business Administrator cannot know for itself of tax rate changes or changes in tax law. Thus it is important that you get a more true opinion of what tax you should pay. For example, consult an accountant.

Business Administrator knows about the taxes that have been received (assuming it has been told everything) – it has been running the Cash Book, and a host of other functions. It makes sense, then, that it completes the process by being in a position to state the taxes it's received, and offer you the method to pay them. Choose the tax description from the functions list, as appropriate. Business Administrator will list the taxes, of that type, that are due. Generally speaking, you should pay that entire list.

In any case, select the items in the list you want to pay and answer the questions that appear. The fields on the left are probably filled in, and you just need to double-check them. The fields on the right are mandatory. In the case of VAT, and at the time of VAT reporting, Business Administrator marked everything as temporarily accounted for. On completion of this dialogue box, it will go through those same items, and fully account for them, declaring that the taxes are paid. Whichever tax you have chosen, Business Administrator will update the Cash Book, and do anything else that needs to be done.

Edit Tax Rates: With Business Administrator being so heavily involved with the trade in your business, and with it on a mission to administer it, it will need to understand the taxes that apply, and the rates that should be in operation. This is the tool with which to tell Business Administrator. Also, tax rates frequently change, and you can easily tell Business Administrator what the new values are. Clearly you should only do this on the moment they change.

Although the functions include the ability to add a New Tax Code (this is not an employee tax code), it is not always practical to use it. It is for Chalestra to implement it in Business Administrator's software development. This dialogue really is for editing tax rates. Cases where you can use the New Tax Code facility include those moments when the government issue a new tax rate under a breed that already exists. For example, Business Administrator understands VAT – so if the government introduces a new VAT rate of, say, 12% on top of the existing 17.5% then you can enter the new tax code. You cannot enter a new breed of tax.

This is normally set to the jurisdiction you're in, and you shouldn't change it. However, if you operate in another country, other than the base one, then you will need to tell Business Administrator that this tax code applies to the other jurisdiction.

Reconcile Cash Book: In order to perform Financial Reporting, it is essential that the Cash Book is accurate. This system allows you to compare Cash Book entries against bank statements. Click on an item, and you will see that you can mark it as reconciled by clicking on Reconcile Entry. That item will disappear from the list, and is assumed to be OK. If the item is not OK you could click on Protect Data (to switch if off) and you will have the right to edit the data. If you want to see items you have reconciled today, click on Include Today's Reconciliations, and, if you want to see those from the past, click on Include Previously Reconciled. You can also click on the Add Bank Charges if the bank has added charges to your business account. If you want to cancel the operation, you MUST click on Clear Today's Reconciliations first.

VAT Reporting: From time to time, it is necessary to report for VAT, if you are VAT registered. The reports from Business Administrator do not analyse VAT in any way. The reports simply make a statement on the trade that has taken place in the period concerned. When the report has printed, you, or your accountant, need to assess it, and conclude on the amount of VAT due to Inland Revenue.

From here, you can get three types of report. Two of them are Mock Reports, one to the screen, the other to the printer. On printing, these Business Administrator will not declare anything as having been submitted for VAT: it is to give you time to get everything you need together in preparation for the VAT Return. You can see the Report on-screen (Preview) or print it out (Printer).

The only way that Business Administrator will officially declare everything as reported is if you print a Conclusive Report. It will print two overview reports (one for you, one for your accountant) and it will print a copy of the invoices and receipts that have been raised in the period concerned. Even when you have printed a Conclusive Report, the process is not complete. It won't be until payment of VAT is sent to Inland Revenue. Be sure that, when you pay the VAT, you tell Business Administrator. Business Administrator will then close off all items, and mark the job as complete. You can also build and print a checklist to remind of of things to do or items to send with the VAT Returns if you send them to an accountant. It has bee shown to be vital that you keep a paper record of all conclusive VAT Reports.

It is important to tell Business Administrator immediately of any changes in the rates.

Manage Bank Accounts: it is within this dialogue that you tell Business Administrator about the bank accounts you have. By doing so, it will help you keep track of funds.

Petty Cash: If your business uses a petty cash system then this command will allow you to tell Business Administrator that you are making a withdrawal of cash for petty cash purposes. You should keep a record of what those items are. Business Administrator tends to discourage petty cash usage, since it is one of those functions that opens the way to fraud. It would prefer to lay the onus on staff, and they would enter it through the expenses systems and have it remunerated with their wages.

Banking: If you accept cash or cheques from customers, and take them to the bank, then this command allows you to inform Business Administrator, allowing it to enter such details into the Cash Book. It also sets up logical processes for banking and the reporting of it. In this dialogue, the items on the left are due for banking, and the items on the right are going through the banking process: they have not be declared as banked. To declare them as banked, when you return from the bank, be sure to come back to the dialogue and ‘Report Banking Done’. ‘Bulk takings’ refers to large cash sums that cannot be registered on the system: beware of laundering money here.

Bank Charges: Bank Charges provides you with the opportunity to enter charges, which your bank makes to your account, into the Cash Book system. This is necessary for Cash Book Reconciliation, and Financial Reporting. Firstly, you need to say what date the bank charges were entered into your account. Having done this, Lock the Date. If this is the first use, you will need to click on Description and enter the name of the charge (e.g., Standing Charge), else you can double-click on the name of the charge in the list. Enter the quantity of the item that the bank has charged you for, and the price each. You can now click on Update Information, and a record of the transaction will be kept. Business Administrator will keep track of the running total as you add items, the transaction will be entered into the Cash Book, and the Cash Book will be kept up to date. You can Unlock Date if you want to work with a different occasion on which the bank made such charges to your account.

Credit Repayments: Occasionally you may decide to take on a loan for your business, or enter into some other sort of credit agreement. This facility allows you to enter details of it. The real benefit is that it will assume that monthly transactions are made, and keep the Cash Book up to date. Apart from the initiation and management of the transaction, the remainder is part of the Shadow Function systems (i.e., their repayment processes are transparent to the user), and the Shadow Systems update the Cash Book as time goes by.

Asset Management: This provides a dialogue box where you can edit the state of each asset in your business. When defining assets, you are probably not wise to include staplers, pens and the likes, but certainly include bigger items. You should check with your accountant and auditor to find out what they do want you to report on. Alternatively, you should consult with your tax office.

Import Asset List: this is a handy way to import a list of assets. You might do this if your business acquires another, and you need to import its assets quickly.