Fine-tuning of the state of assets means that your tax liabilities are likely to be improved. Badly managed assets, alone, can have a major impact on tax results, and is likely to have a deteriorated effect on business management. Business Administrator manages only tangible assets in this dialogue.

Location: Finance Manager, Asset Review

Overview

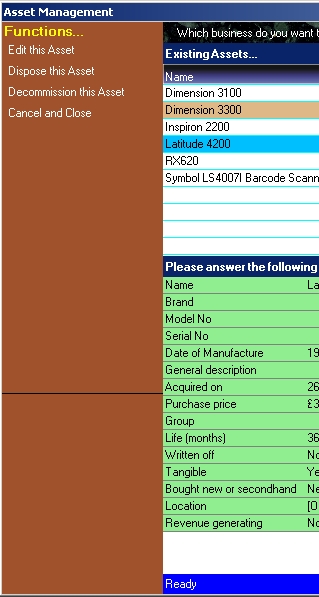

Business Administrator would like you to keep details of your assets as accurate as possible. To that end, a number of ways of managing tangible assets are provided.

Editing asset details

The dialogue shows you items that need urgent attention by displaying them in red. Double-click one of these, or choose Edit this Asset from the Function Bar, to edit its details.

Disposing of an Asset

Disposal of an asset is necessary if it is not capable of work, either because it has been stolen, destroyed, or some other reason that has put it in a state that it can’t be used. Defining the disposal is easy, but you must explain why it has been disposed of: the more comprehensive the explanation, the better you will be able to explain it when asked.

If it was sold, then should also state the price you got for it, even it it’s negative.

Select ‘Dispose of this Asset’ on a selected item to begin the disposal statement

Decommissioning an Asset

You might decommission an asset if it’s still in your possession and capable of doing its job, but you have no further use for it. In this state, you would probably sell it.

But the statement that it has been decommissioned and is not working for your business is vital for tax reasons.

To move to decommissioning an asset, select ‘Decommission as Asset’ from the Function Bar after selecting the asset.

New assets

It might seem strange that there is no facility in Asset Management to add a new asset. There are three main ways in which assets come to a business…

The first is through procurement of new or second-hand assets. For these, they are defined as assets when you order them using Supply Chain Manager.

The second is through business acquisition, where you buy the assets as part of a deal. For these, you should create a list of the assets and import that list from Finance Manager, Asset Review and Asset Import.

The third way to gain assets is to make the assets yourself. You should define this process in Project Manager using a manufacturing template. However, if you bought the resources, then you should describe that purchase in Supply Chain Manager. If the resources came from the land you have, then that land should also be marked as an asset.

So Asset Manager always manages assets after their point of acquisition.

Asset replacement

All assets have a life span, and new assets often replace existing assets. Business Administrator manages asset replacement in Asset Management. You get one chance to state that a new asset replaces another, and you have to state how the original asset is being disposed. You can only replace an asset that is being disposed: you cannot replace an asset that is being decommissioned.

When an asset is bought into the business, some further work will need to be done for the asset in Asset Management: these are the items in red. In editing those items, you are given the chance to state that the asset replaces another, and to state how the original is to be disposed.