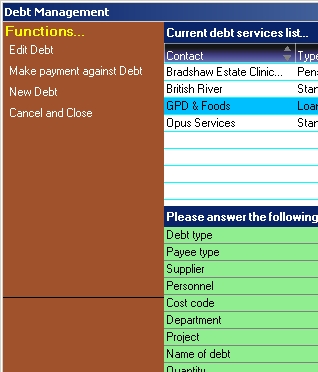

The Debt Management, or Credit Repayments, dialogue allows you to define debt or credit repayments, allowing Business Administrator to automatically keep the Cash Book up to date, and allowing Business Administrator to be able to report on the state of the finances of your business.

Location: Finance Manager, Banking and Debt

Overview

Occasionally you may decide to take on a loan for your business, or enter into some other sort of credit agreement. Or it might be contributions to a pension. This facility allows you to enter details of it.

You may also want to pay for services on a monthly basis such as accountancy fees.

The real benefit of credit management is that Business Administrator will assume that monthly transactions are made, and keep the Cash Book up to date. Apart from the initiation and management of the transaction, the remainder is part of the Shadow Function systems (i.e., their repayment processes are transparent to the user), and the Shadow Systems update the Cash Book as time goes by: there is little for you to do.

To enter a new debt or arrangement, click New Debt from the Function Bar, select the type of debt in the Q&A, and complete the remainder of the form as necessary.

When editing an existing debt, be sure that all parties, including your bank, know about the changes. Business Administrator will not inform them.

If you decide that you want to pay off part or all of the debt, you can do this by clicking Make Payment against Debt.

Q&A terms

Depending on what you are doing, you may see a variety of the following Q&A. For some of the items, Business Administrator will calculate the answers if it has enough information.

Debt type: What type of debt or arrangement are you taking on?

Payee type: What type of entity is owed the money?

Supplier: Who is the supplier of this item, or the provider of the debt?

Personnel: To which member of staff is owed the debt, if it is a member of staff?

Cost code: What is the money to be used for?

Department: Which department will this debt be charged to, if you have more than one department?

Project: Which project does this debt apply to, if the cause of the debt is because of a project you are taking on?

Name of debt: You must give a name to the debt.

Quantity: How many items are involved in this purchase?

Monthly payment: What is the Monthly payment of all the items?

Consumer Tax Value: What is the Consumer Tax charged on the Monthly payment? Note that Business Administrator knows VAT as Consumer Tax.

Base Consumer Tax: What base Consumer Tax should be applied?

Premium: What is the Premium for this debt (i.e. what is the total amount)?

Cost of debt: How much did it cost to arrange the debt?

Interest: What interest will be charged against this debt?

Consumer Tax on interest: How much VAT will be charged on the interest this debt?

Grand total: What is the total for the Monthly payment + Consumer Tax

Debt range (months): Over what period (in months) will the debt be repaid? (0 means infinitely and 1 means 1 payment only)

Initial date: When will the first payment be made?

Normal transaction date: What day of the month will the repayment normally take place? For example, 5 will mean the 5th day of the month.

Initial payment: What will the first payment be, if it is not the normal repayment?

Normal payment: What will the monthly payment be generally?

Final payment: What will the final payment be, if it is different to the normal repayment price?

Repayment Consumer Tax rate: What is the Consumer Tax rate on the repayment?

Account to withdraw from: Select the bank account from which the funds will be withdrawn.